Explicit Risk Mitigation In Growth Investing

NewWorld seeks explicit risk mitigation by avoiding the “Six Devils” in company investing.

The Six Devils:

-

Technology Risk

- Ensure product development, sourcing, deployment, and market acceptance has occurred

- Require a revenue record and positive EBITDA

- Prefer business scaling possible with existing manufacturing facilities or low-cost expansion/outsourcing

- Test Backwards Compatibility to existing downstream distribution and after-sales service

-

Regulatory/ Subsidy Risk

- Evaluate on a case-by-case basis

- Do not factor anticipated regulatory policy

- Use subsidies as an aid, not a foundation

-

Hydrocarbon Pricing Risk

- Avoid companies whose value depends on high hydrocarbon prices

- Minimize hydrocarbon pricing volatility by preferring companies less relient on hydrocarbon energy

- Prefer companies with low transportation and distribution costs

-

Capital Scale Risk

- Avoid asset-intensive products / businesses that require substantial upfront investment

- Prefer milestone-based fund release

-

International Competitor Risk

- Avoid segments targeted by China or other Southeast Asia competitors that may benefit from significant market scale, cost and regulatory-support advantages in sectors prioritized by their governments

-

Business Scaling Risk

- Ensure a real sales pipeline exists prior to investment

- Establish a close working relationship with the management team/fill management skill gaps

- Leverage NewWorld’s business-building skills

- Intervene quickly on management issues

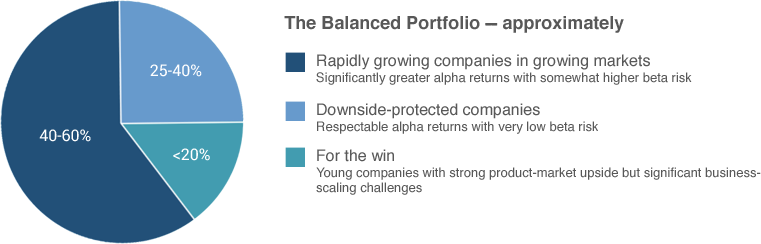

NewWorld also seeks to reduce portfolio level risk by building a diversified portfolio across industry segments, diversifying value factors and risk factors within the portfolio, and seeking some Horizon 1 investments (as well as others requiring longer to develop to full scale).